-

+91-9819602581

- Open MF account

Financial Planning (FP) is the process of achieving your life goals by using different investment and risk mitigation tools with your current resources through proper and disciplined money management.FP is not only about money, but it is all about life, about fulfilling your wishes, dreams, aspirations and your enjoyment in achieving them.

Financial Planning covers major financial areas of your life addressing aspects such as assets, liabilities, cash flow, savings, debt management, risk management, children’s education planning, taxation, retirement planning, estate planning, and of course, investments and a strategy for managing them.

Financial plan is like having a travel plan - it identifies where you are going, how and when you will get there, how much will it cost, and things to do along the way. A personal financial plan looks at where you are today and where you want to go. Then it sets out all the steps you need to take to get there. Everyone who is earning should draw up a financial plan. The plan will help you get the most from your money and help you in achieving your financial goals in life.

Who needs a Financial Planning?

Anyone who earn income be it a salaried person or a businessman; you have a family or are planning to have one; have life goals, retirement dreams that are unique to you.

No one can predict the future but one can certainly be better prepared for it.

An effective financial plan will make sure that you are financially prepared to deal with the unexpected events and stormy times. If you don’t have one, you are more likely to end up in a financial mess. On the contrary, if you have one and the recommendations thereon have been executed, most of your financial goals will be satisfactorily met.

A good financial plan can alert you to the changes that must be made to make sure a smooth transition through life’s financial phases, such as decreasing spending or changing asset allocation, etc.

Why we recommend you plan for Financial Plan today, as it will help you to:

You need not be very rich to have a financial plan. No matter how much you earn and at what age, a plan is important to make your life easier. As your financial situation influences almost every aspect of your life, a regular financial plan can help give you peace of mind and protect you from unforeseen, unfavourable situations. Once you have a working personal financial plan, you can use it to make informed financial choices. It will allow you to analyse your wants versus your needs.

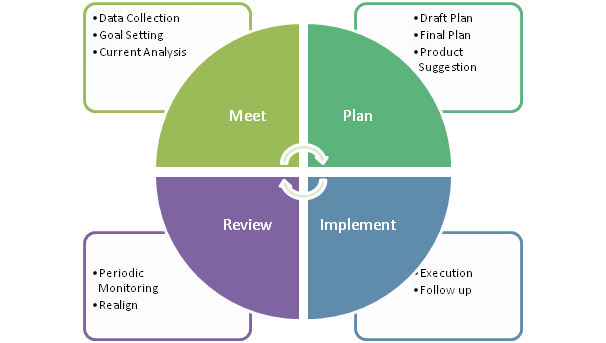

Bonaventure’s Financial Planning Process:

Prepare you for all life events small or big

For Financial Planning services, seek an appointment or reach out to us on details under contact andvisit us on www.bonaventure.in